Fairmount Plaza will undergo a needed refresh

I read the recent Post & Courier article about Fairmount Plaza wearing two hats I know well.

One as someone who’s spent a long career in commercial real estate — often representing landlords and seeing how these situations actually play out.

The other as the publisher of CHS Happenings, where I’ve been unapologetically pro–local business from day one. I’ll walk past ten Starbucks to get to a great locally owned coffee shop. Bezos doesn’t need more of your money. That’s not branding. That’s belief.

Those two hats don’t conflict here. They inform each other.

Where the outrage actually lives

To be clear, the tenants quoted in the article aren’t shouting into the void. They’re worried. Anxious. Trying to make sense of a big, disruptive change.

The real outrage shows up somewhere else.

It shows up in comment sections. On Facebook. In neighborhood threads. In the familiar chorus that kicks in almost every time a landlord or property owner enters the conversation:

Greedy landlord.

Corporate takeover.

Here we go again.

I’ve seen this reaction play out dozens of times over the years — not just in this case. And in well over 90 percent of them, the public lands in the same place before reading past the headline.

That’s the outrage I’m talking about.

The fear is real — but it’s not the whole story

If I were Davide Davino at Cuoco Pazzo Trattoria, looking at the possibility of my rent jumping from $4,800 a month to nearly $16,000, I wouldn’t need social media to tell me that’s frightening.

That’s payroll. That’s margins. That’s whether a business built over 18 years still works in the place it helped define.

So yes — the fear tenants are feeling is real. Full stop.

But fear alone doesn’t automatically make the other side unreasonable.

“Rent triples” — and assumptions rush in

“Rent triples” is a powerful phrase. It does exactly what headlines are designed to do: provoke an immediate reaction.

For many readers, that reaction is also the conclusion.

What often gets skipped is a line buried deeper in the article — one that complicates the narrative in an important way. A tenant says it plainly:

“We knew this day was coming when the below-market rents we have been paying would come due.”

That sentence doesn’t minimize the disruption. But it does explain it.

Fairmount Plaza didn’t collapse — it transitioned

Fairmount Plaza was owned for decades by a classic mom-and-pop landlord who bought the property in 1992 and prioritized stability over maximizing rent.

That allowed tenants to operate with occupancy costs far below what comparable Mount Pleasant retail commanded. In return, the center received basic maintenance — not constant reinvestment.

That arrangement worked. For a long time.

But retail centers age. Roofs wear out. Parking lots deteriorate. Facades date themselves. Town standards rise. Shoppers expect more.

Eventually, someone has to write real checks.

When an owner no longer has the capital — or the appetite — to do that, the property sells. And when it sells in a market like Mount Pleasant, it sells into demand.

That’s what happened here.

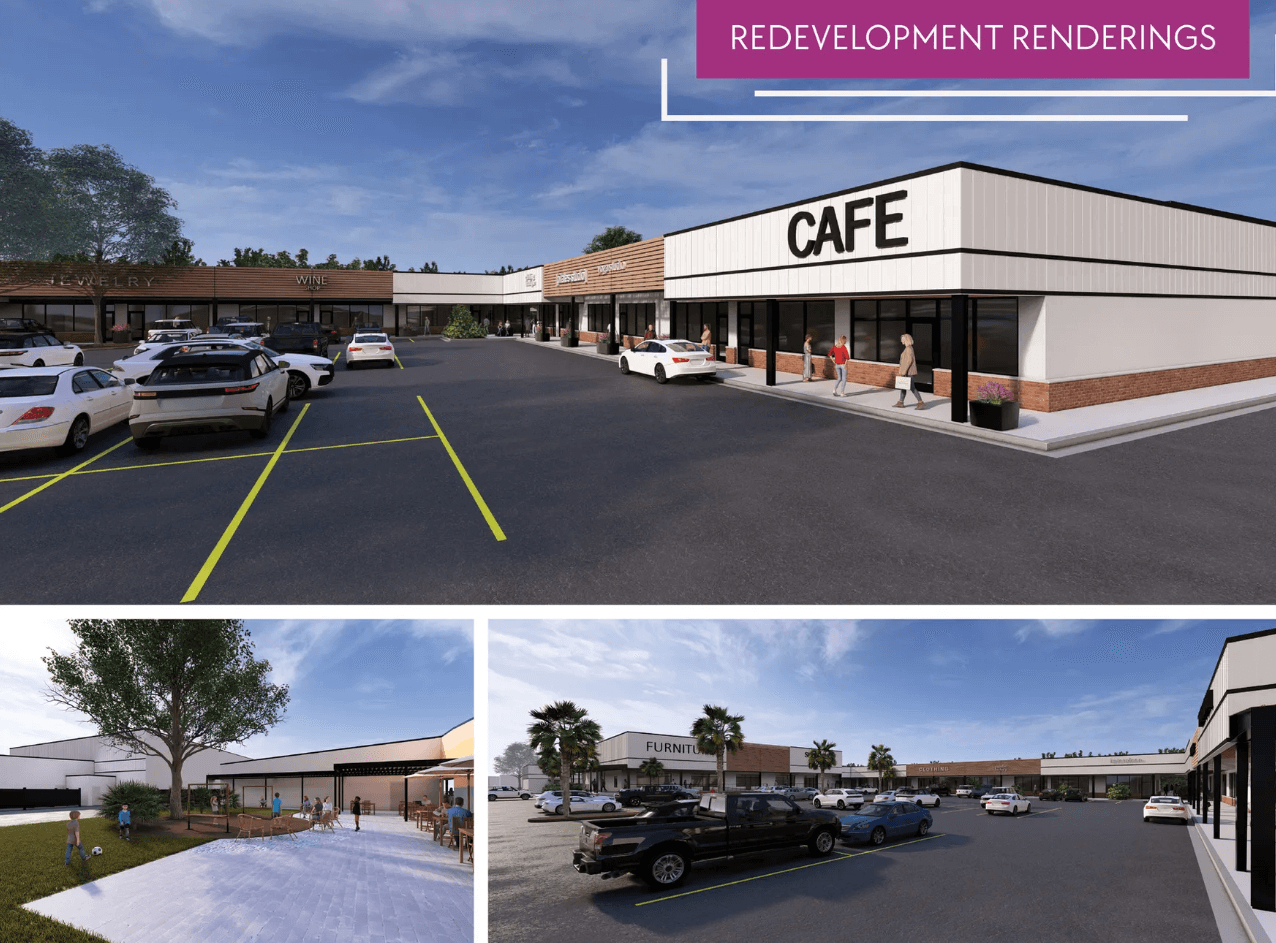

Renderings of proposed renovation

The part outrage never accounts for

Here’s what almost never makes it into public reaction: landlords don’t want tenants to leave.

Not emotionally. Financially.

When a retail tenant vacates, the landlord almost always takes a hit — often a significant one:

Downtime: six months is common; a year isn’t unusual — with zero rent coming in

Demolition and remodeling costs to reset the space

Tenant improvement allowances paid to attract the next tenant

Leasing commissions

Legal fees

From a purely economic standpoint, keeping a successful, established tenant is usually the cheaper option.

That’s why I don’t scoff when RCB Development says it wants to retain existing businesses. Not because they’re heroes — but because that’s how retail ownership works when you’re protecting a serious investment.

They paid $15 million for the property. They’re planning long-deferred renovations. That investment has to be supported somehow.

Outrage is easy. Reality isn’t.

Public outrage tends to flatten stories like this into something simple and satisfying: good guys, bad guys, and a headline to rally around.

Real life doesn’t cooperate that neatly.

What’s happening at Fairmount Plaza is disruptive and uncomfortable — for tenants, customers, and a community that values local businesses.

It’s also the predictable result of long-frozen rents meeting a growing market, and deferred investment meeting new ownership.

You can fiercely support local businesses — I do — without defaulting to the assumption that every landlord is acting out of greed.

If we actually want to protect the places we love, we need to move past reflex outrage and start talking honestly about how moments like this happen — and how to navigate them without losing what made these places worth caring about in the first place.

That conversation takes more effort.

But it’s the one that actually helps.