The big news around town a week ago was Mount Pleasant Town Council voting 7-1 to deny approval of a redevelopment plan put forward by the owner of Mount Pleasant Towne Centre. I wanted to wait a week or so before I weighed in on this, which I’ve done previously.

To see whether, after the proverbial smoke cleared, I’d feel differently.

I don’t.

Mount Pleasant caved to NIMBYs.

Before we get to why, it's worth revisiting history.

Mount Pleasant Towne Centre & A Bit Of History

When the Towne Centre opened in Spring of 1999, “lifestyle centers” were a growing trend in shopping center development. Lifestyle centers—open-air shopping centers with upscale stores and a pedestrian-focused design—started to become popular in the United States in the late 1980s. The concept is widely credited to Memphis developers Dan Poag and Terry McEwen, with the first recognized lifestyle center being the Shops of Saddle Creek in Germantown, Tennessee, which opened in 1987.

While I wasn’t living here when Towne Centre opened, I can imagine how exciting it was. This was a big deal! Charleston’s version of the (close to) 21st Century mall.

And it was a coup for Charleston, too. The regional population was around 540,000 at the time, considered average to support a lifestyle center of a half-million square feet. Especially since Citadel Mall had been operating here since 1981. I’m sure the developer lured tenants by reminding them of Charleston’s impressive tourism numbers, a bit over $2 billion in economic impact.

From Then To Now

The roster at Towne Centre has certainly changed in the 26 years since it opened. A lot has changed in retail since then, not only nationally but in Charleston.

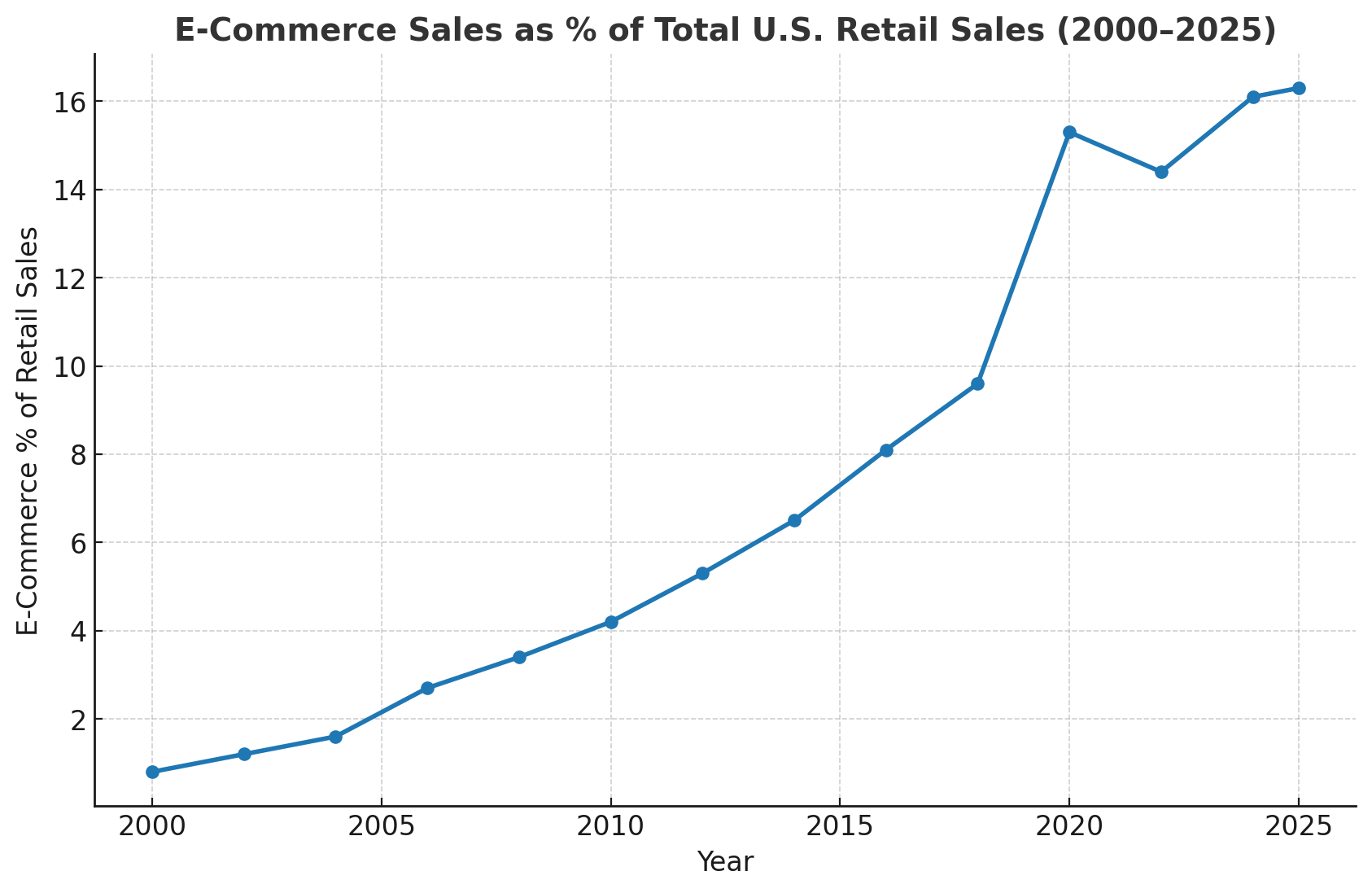

Amazon was founded in 1994 and expanded outside of books in 1998. It was right around the time Towne Centre opened that Amazon’s growth accelerated. The rest of e-commerce followed.

It’s an obvious point but worth stating that every one of those dollars going to e-commerce had previously been spent in bricks-and-mortar shopping centers like Mount Pleasant Towne Centre. And the Towne Centre opened right as e-commerce sales started taking off.

From Capital One Shopping Research

Over the past 25 years, the Charleston region has seen explosive growth. Retail followed rooftops as a result.

Lee & Associates’ Q3 2024 Retail Report indicated 531,145 square feet of retail space was under construction in Q1 2024.

If half a million square feet of retail space was under construction in early 2024, it stands to reason several million square feet of retail space has been developed in the Charleston area since Towne Centre opened.

Mount Pleasant Towne Centre doesn’t exist in a vacuum. It has to compete in this environment.

The Only Constant Is Change

Last October, after the owner of Towne Centre was asked to go back to the drawing board by Mount Pleasant Town Council, I wrote about how retail space is literally a living, breathing animal. There’s no other type of real estate where an owner has to be as hands-on as retail space.

Things are constantly changing. Shopping trends, consumer preferences, the hottest retailers. An astute property owner must constantly evaluate the foot traffic of its shopping centers, and the one metric that matters most: sales.

Vigilant and proactive retail property owners are successful owners, and they don’t sit on their hands. They aren’t “surprised”. They know everything there is to know about their centers, and they’re obsessed with the health of their retailers. As their tenants go, so goes the success of the shopping center.

And by extension, their investment returns. Because, yes, they're in it to make money.

Fast Forward To The Past Several Years

I count Continental Realty Corporation among the ranks of successful, super-smart, experienced retail owners. They’ve been around since 1960, honing their craft. Their investment partner, The Beach Company, has developed real estate and invested in South Carolina since 1945. If you drew up a partnership to guide the stewardship of Mount Pleasant Towne Centre—to ensure it continues to be successful in a hyper-competitive world—it would be this one.

They may not have been the beneficiary of great timing, though. The partnership invested the exceedingly healthy sum of $147 million to buy the property in February, 2020. Right before COVID. The worst period ever to be a retail property owner.

So I wasn’t surprised in the least when they went to Mount Pleasant to request flexibility in the property’s make-up. They’ve been reading the tea leaves all along!

Tea leaves like the following:

Bed Bath & Beyond, after countless attempts at reinvention, finally threw in the towel and liquidated in July 2023. They left behind a 34,650 square foot vacancy at the Towne Centre. A space, because of its size and difficulty to split—along with the many aforementioned changes in the retail landscape—that hasn’t been re-leased.

The movie theater industry has been under stress FOR YEARS. I wrote about this twice recently. When was the last time you went to see a movie in a theater? The Palmetto Grande theater at Towne Center is 65,000 square feet, a massive space that’s unique in its configuration and depth, making the prospect of needing to re-lease it…scary.

I’ve also written before about Belk’s struggle to deal with generations-long trends moving shoppers from department stores to specialty retailers (Old Navy, Lululemon, Athleta, Men’s Wearhouse, LOFT and the like). Let’s look at just a few warning signs from Belk, all of which Towne Centre’s owners would have been aware of:

In 2015, Belk was acquired by private equity firm Sycamore Partners for $3 billion, $2 billion of which was debt.

In 2020, the pandemic led to store closures and a significant drop in sales. Belk furloughed workers in March and cut senior staff pay up to 50%.

In early-2021, Belk announced they would file for bankruptcy, and subsequently emerged in only 1 day. The terms of the bankruptcy meant they reduced their debt load by $450 million, which left over $1.5 billion in debt.

In July 2024, Belk announced they were reducing debt by $1 billion, while while also amassing about $485 million via new loans. If you’re keeping count, it means their debt load is still over $1 billion.

Researchers and media have documented a pattern: private equity firms often use leveraged buyouts that leave retailers burdened with debt, prioritize short-term returns, and may not be incentivized to ensure long-term company health. When retailers acquired this way face tough market conditions, PE owners frequently opt for bankruptcy and liquidation as a means of recovering whatever capital remains, often resulting in job losses and store closures. Belk is owned by a private equity firm.

So What’s My Beef?

Plainly, it’s the arbitrary process Towne Centre’s owner was asked to go through by Mount Pleasant Town Council. And the comments of several of its members, mainly G.M. Whitley, which indicate they either don’t understand what’s involved in owning and operating a large retail property like Mount Pleasant Towne Centre or don’t care to.

Here’s a condensed timeline of the process:

April 2024: Towne Centre presents initial PD amendment (apartments, hotel, added retail/entertainment, structured parking; up to ~75’ heights).

October 11, 2024: Town Council denies the amendment; Towne Centre indicates intent to revise.

Spring 2025: Towne Centre submits revised plan.

June 18, 2025: Planning Commission recommends approval of revised master plan.

Early July 2025: Council first reading scheduled and then deferred.

Aug 12, 2025: Town Council denies updated plan.

After Towne Centre’s owner did what was asked of them several times—and progress was being made—Town Council ignored the recommendation of its own Planning Commission and denied the request.

They caved to NIMBYs. NIMBYs like Belk and several community members. Let’s examine a few statements made at hearings on August 4 and August 12:

First, in our lease, new construction is only allowed in the existing building areas or other specified permitted building areas. Building in most of the parking lots, sidewalks, drive lanes or green space is not permitted.

Irrelevant. Towne Centre hasn’t requested any changes to Belk’s lease.

Adding housing to the shopping center would alter the character of the retail property.

Per the original development plan, the right already exists to add housing. It allows 4 units per acre of market-rate and an additional bonus of 4 units of attainable housing. Meaning 408 housing units could be delivered by-right.

And Mr. Nickel is right. Housing would alter the character of the property. For the better. Mixed-use retail spaces tend to achieve higher occupancy rates, often between 90–95%, compared to standalone retail properties (80–85%). These developments also see 20–30% more foot traffic and longer customer dwell times, driving robust sales growth and higher customer retention rates.

Not to mention adding housing would address the affordability crisis in Mount Pleasant, particularly for our younger residents. But that’s a story for a different day.

Owners have been free to build homes for years but have yet to build one.

She’s right. But what does that have to do with this request?

And I’ve saved the worst for last.

What I do know is that if all this is entitled into this property, the valuation of this property goes up significantly. I’m not comfortable giving the gift of hundreds of millions upon millions of dollars to a developer in exchange for a hundred affordable housing units when we have developers in our community who are building affordable housing.

Umm…no.

Councilmember Whitley is under the delusion that Town Council would act as magic wand-wavers, immediately bestowing “millions upon millions” of dollars in increased value to Towne Centre’s owners.

In reality, little to no value would occur with the mere approval of a redevelopment plan. That doesn’t happen until Towne Centre’s owners and principals go at risk.

If/when Palmetto Grande or Belk vacated, here’s just a few things the owners would need to do before skies parted, a rainbow formed and their pot of gold emerged:

Incur months if not several years of lost rent on the spaces.

Negotiate fair pricing with general contractors in an environment where construction pricing is always going up

Sign personally for loans in the millions of dollars

Raise investor funds to go along with the debt

Invest hundreds of thousands of dollars in architectural, legal, marketing and other fees

Invest tens of millions of dollars in creating housing, garage and hotel

Lease/rent the apartments

What’s Next?

Now everyone waits and hopes.

Hopes that Palmetto Grande and Belk can buck years-long trends working against them.

And if they don’t?

Mount Pleasant Towne Centre will have the dubious distinction of having 4 large spaces dark. For a while.